Modern digital wallets have become multifunctional platforms that harmoniously combine banking services, identification tools, and commerce tools. From the active implementation of advanced biometric security to personalization using artificial intelligence, digital wallets are changing our current approaches to financial management processes and the use of digital services.

This material examines the key industry trends, key technical challenges, and promising market opportunities that are shaping the future of digital wallets in 2025. It offers actionable recommendations for creating a competitive product now to stay ahead of market expectations.

Key Development Trends in Digital Wallets for 2025

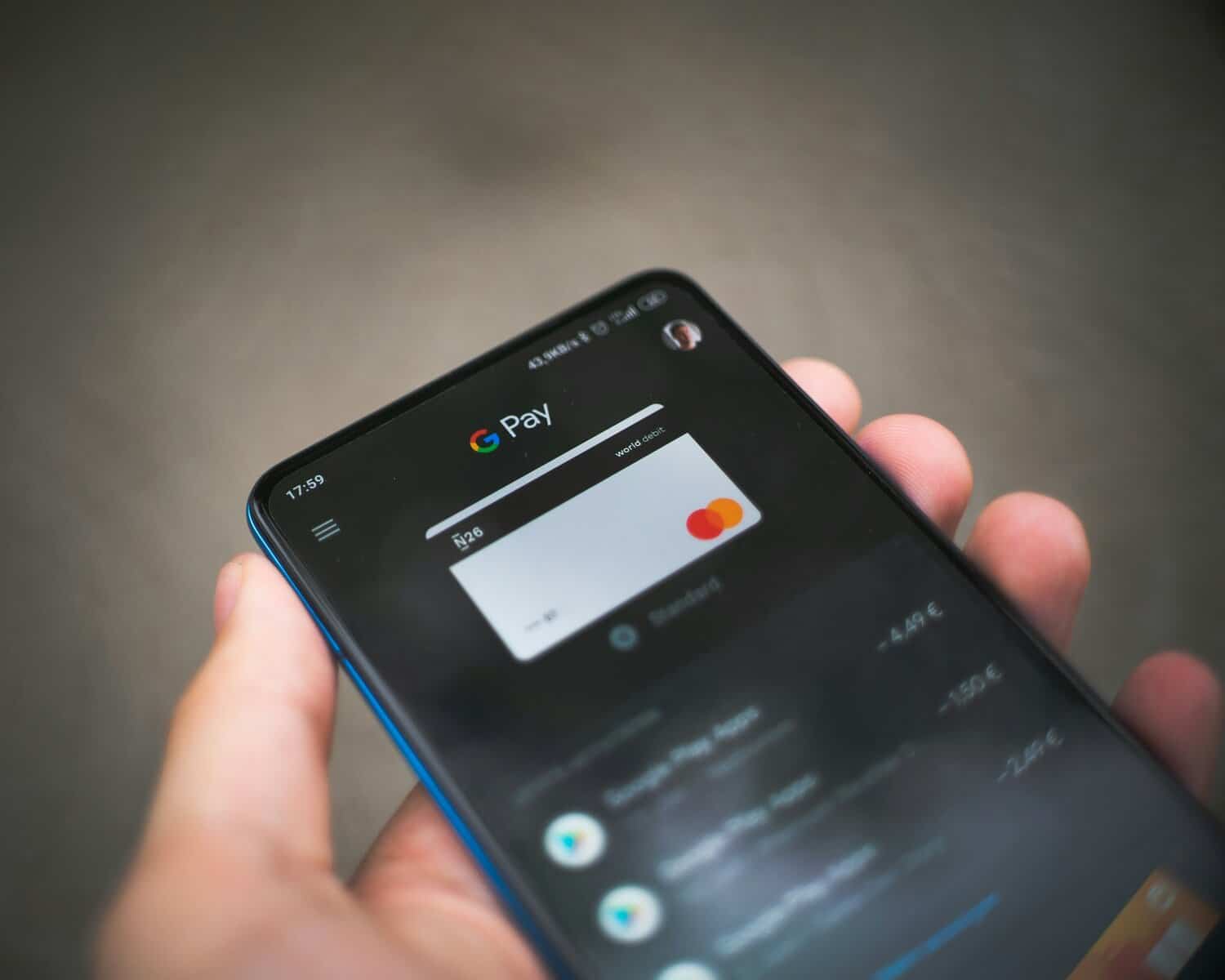

The key trends in digital wallets forecasted for 2025 include a number of significant changes and innovations. In particular, contactless payments are expected to continue to grow in popularity, becoming an integral part of users' daily lives. Biometric authentication technologies, such as fingerprint scanning or facial recognition, will be even more widely used to increase the security and convenience of transactions. Digital wallet development trends are rapidly evolving, with a strong focus on enhanced security features and seamless user experiences.

Incorporation of AI and Machine Learning

Everyone has probably heard about the various opportunities provided by artificial intelligence and machine learning. These opportunities are becoming key components of the new generation of digital wallets. In 2025, these innovative technologies offer a wide range of opportunities: from personalized financial advice and expense monitoring to effective detection of any manifestations of fraud:

- Modern digital wallets carefully analyze the behavioral patterns of users. This is necessary to ensure smart budgeting, timely warning about unusual transactions, and automate regular payments;

- Various chatbots operating based on artificial intelligence provide operational financial advice (which is as informative as possible for users, solving their current problems);

- Predictive algorithms examine financial habits as thoroughly as possible, helping to improve the economic stability of users.

Integration of Biometric Authentication and Enhanced Security

The integration of biometric authentication and enhanced security functionality into digital wallets, combined with artificial intelligence, is able to detect anomalous actions, such as unusual geolocation or atypical authorization methods, and, if necessary, include additional layers of verification. Zero-trust architecture and hardware-supported security modules provide maximum protection without complications in everyday use. Innovations like biometric authentication and blockchain integration are shaping the future of digital wallet development trends.

Expansion of Contactless and QR Code Payments

Digital wallets in 2025 will allow for easy contactless transactions on public transport, in stores, and even between users. Dynamic QR codes are being introduced to increase the security and speed of payments. This experience will help attract even more users to digital financial solutions.

Support for Multi-Currency and Cryptocurrency Transactions

In 2025, leading digital wallets will support not only fiat currencies, but also cryptocurrencies, stablecoins, and CBDCs. Full compatibility with popular blockchains ensures secure transactions, storage, and exchange of digital assets. Businesses tapping into these digital wallet market opportunities can gain a competitive edge by offering convenient, fast, and secure payment solutions.

Technical Challenges in Digital Wallet Development

The technical aspects of creating digital wallets are accompanied by a number of problems and key challenges that make their development and implementation difficult. First of all, this ensures a high level of security, because digital wallets work with confidential user data, including financial information. Despite the growth, digital wallet challenges such as regulatory compliance and fraud prevention remain significant obstacles.

Scalability and Performance Under High Transaction Volumes

With digital wallets serving millions of users and processing billions of transactions every day, ensuring seamless scalability is a top priority. The infrastructure for such systems must be able to handle peak loads without interruption or failure, especially during peak periods such as holiday sales, force majeure situations, or unexpected spikes in activity.

Integration with Legacy Banking Systems

One of the most challenging aspects of developing modern wallets is integrating with legacy banking infrastructures. Legacy APIs, outdated protocols, and incompatibility of data formats often create obstacles to ensuring real-time interaction with banks. Developers are focusing on using specialized software intermediary platforms and Banking-as-a-Service (BaaS) services that facilitate the integration process.

User Experience and Accessibility Challenges

In 2025, the UX design of e-wallets should meet the needs of both experienced users and those who are new to digital finance. The interface should be as intuitive as possible, multilingual, and include accessibility tools for people with disabilities. Ease of adaptation, clear navigation, and informative support should be considered key characteristics of a successful product.

Market Opportunities in the Digital Wallet Space

The market opportunities in the field of digital wallets are huge, given the growth of digitalization and the popularity of cashless payments. Digital wallets are becoming an integral aspect of the functioning of the financial system, providing simplified payment processes, comprehensive integration with loyalty systems, and the possibility of international transactions. Choosing the right digital wallet app development company is crucial for building a secure and user-friendly payment platform.

Partnerships with Retailers and Financial Institutions

Partnerships with retailers and banks offer significant growth potential. Wallets integrated with both online and offline purchases are set to become popular in 2025. Digital wallets help engage customers through loyalty programs, personalized offers, and instant loan approvals. Banks benefit from co-branding, audience expansion, and integrated financial services.

Financial institutions can enhance these partnerships by integrating specialized investment banking software solutions that enable sophisticated wealth management features within digital wallet platforms.

Leveraging Open Banking APIs

Open banking APIs are creating entirely new, profitable opportunities, allowing wallets to merge accounts, streamline transfers, and offer profitable products. Digital wallets are becoming the center of financial management, automating transfers or micro-investments.

Expansion Beyond Payments: Digital Identity and Loyalty

Digital wallets go beyond payments to store personal information, medical records, and other documents. These changes are making it easier to travel, login, and manage rewards. Users can verify their identity or customize their experience with just a few taps. The digital wallet market opportunities are expanding as more consumers prefer contactless payments and digital currencies.

How to Approach Digital Wallet Development in 2025

If you’re wondering how to create a digital wallet, start by defining your target users, selecting the right technology stack, and prioritizing security measures. It is important to understand the needs of your audience. Determine who your target audience is: experienced cryptocurrency traders or residents of regions where financial services are limited. Build a user-friendly interface, design the necessary functionality, and provide high-quality support based on their requests.

Integrate biometric authentication, end-to-end encryption, and fraud detection technologies early in the development process. Security should be a central element, not an additional option. Use modular API-based solutions that will allow the wallet to easily integrate with new currencies, payment systems, and technological trends. Consider Know Your Customer (KYC), Anti-Money Laundering (AML), and Data Protection requirements early. Regular dialogue with legal and compliance professionals will help minimize risks and streamline processes.